Frederick the Great Quote: “No government can exist without taxation. The money must necessarily be levied on the people; and the grand art consists...”

1. Levy To forcibly place a tax The colonists became angry about all the taxes that the British levied on them. Causes of the American Revolution Vocabulary. - ppt download

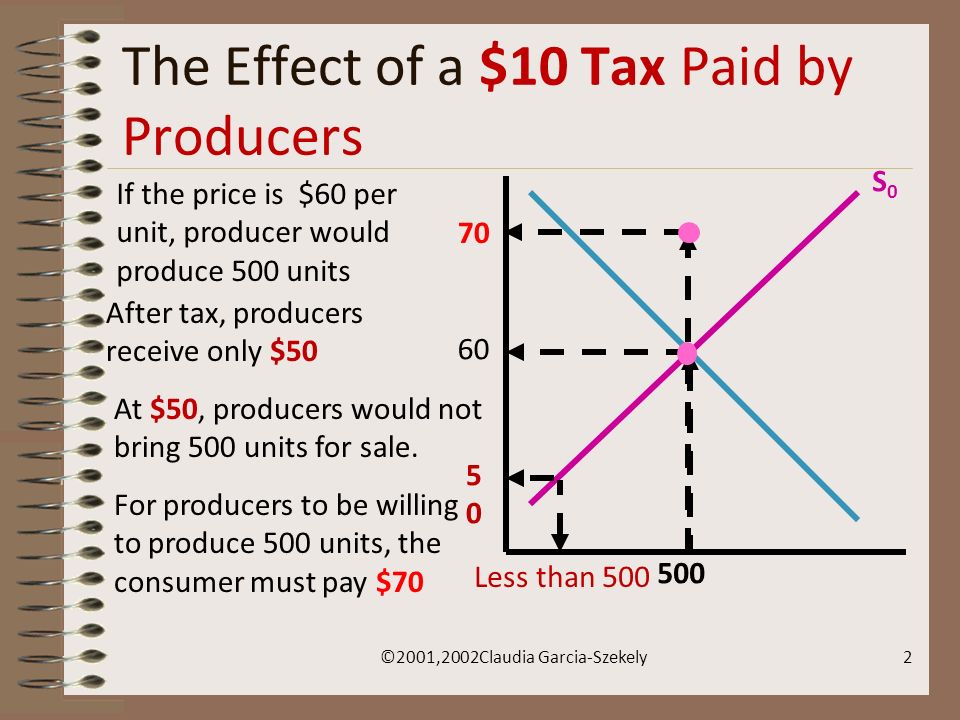

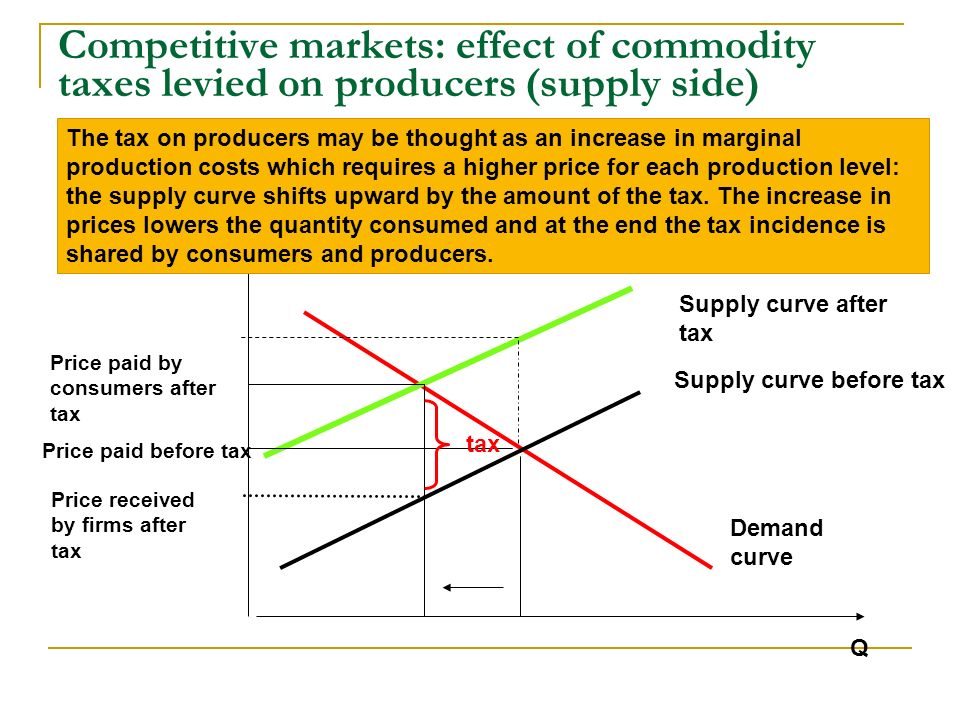

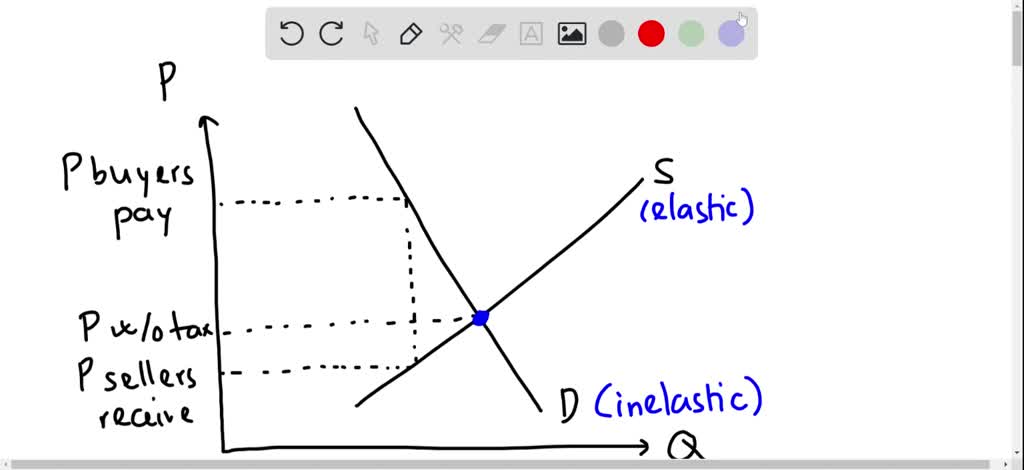

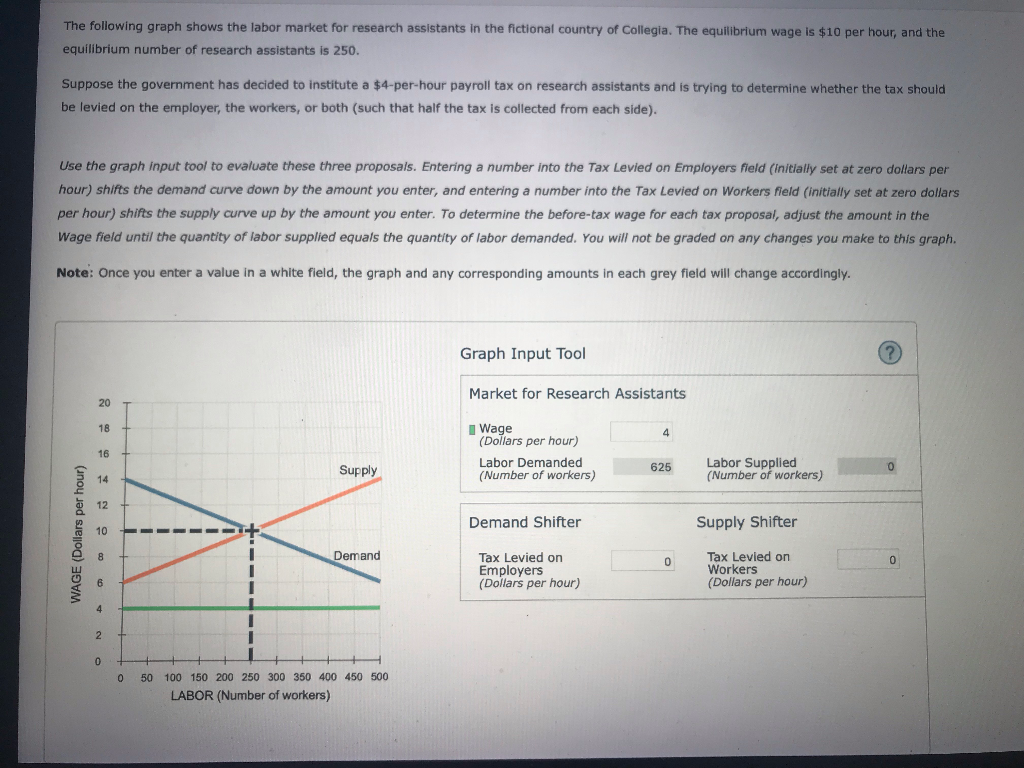

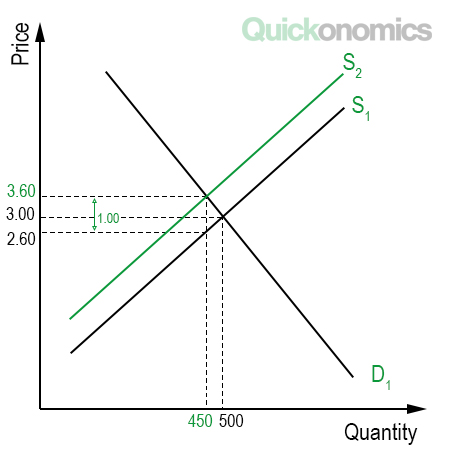

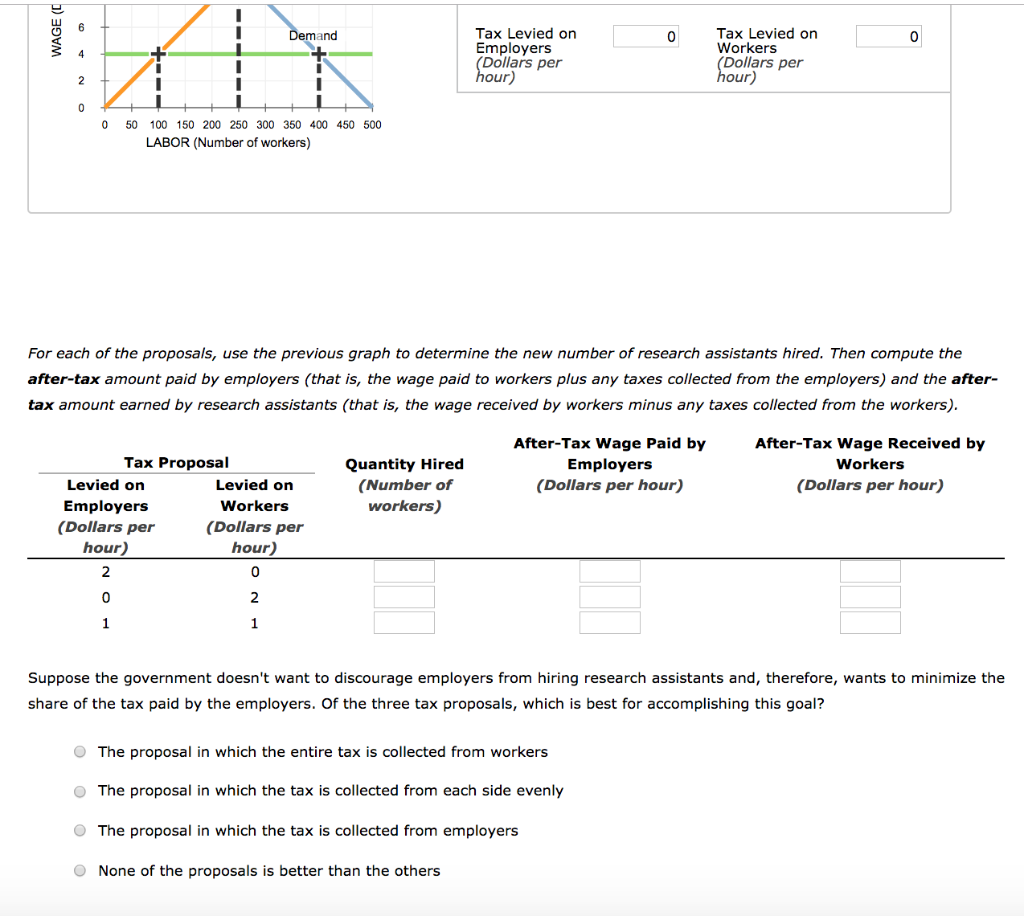

Using the mechanics of supply and demand, what does a tax do? How does it affect supply and demand and quantity in markets? | Homework.Study.com

Excise taxes blue concept icon. Legislated taxation on purchased goods idea thin line illustration. Tax levied on commodities and activities. Vector i Stock Vector Image & Art - Alamy

Excise Taxes Concept Icon Legislated Taxation On Specific Goods Idea Thin Line Illustration Tax Levied On Commodities Services And Activities Vector Isolated Outline Drawing Editable Stroke Stock Illustration - Download Image Now -

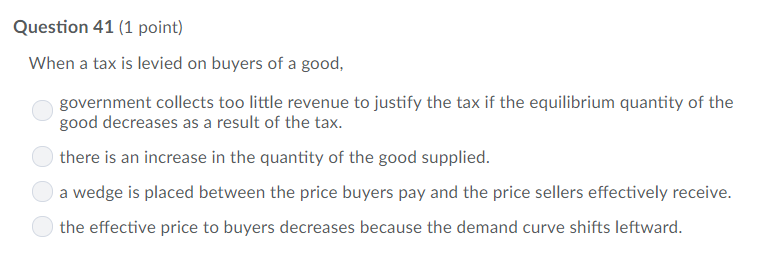

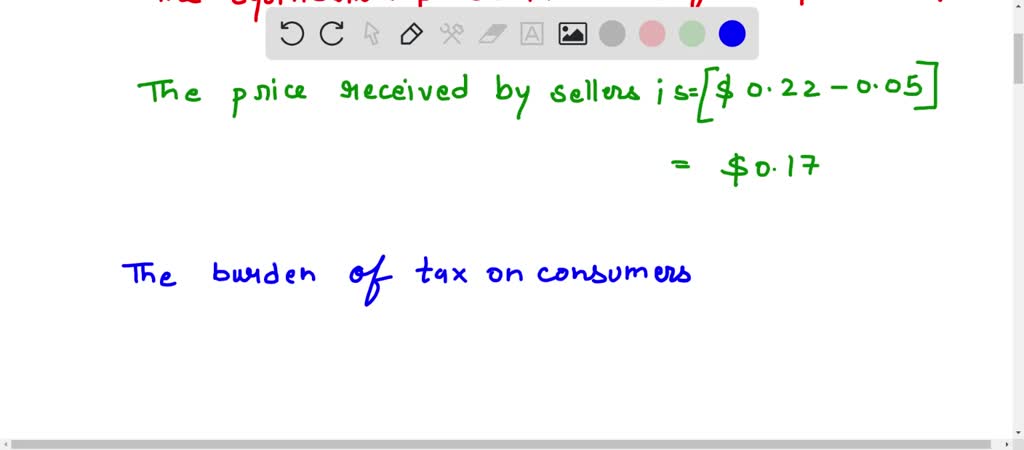

SOLVED: When a good is taxed, the burden of the tax falls mainly on consumers if a. the tax is levied on consumers. b. the tax is levied on producers. c. supply

BDO Global Tax Alert | AUSTRIA - Government announces windfall tax to be levied on domestic energy companies - BDO

A tax levied on the buyers (demand side) of a product: A. Leads to a lower equilibrium B. Shifts the demand curve to the right C. Has no effect on the supply

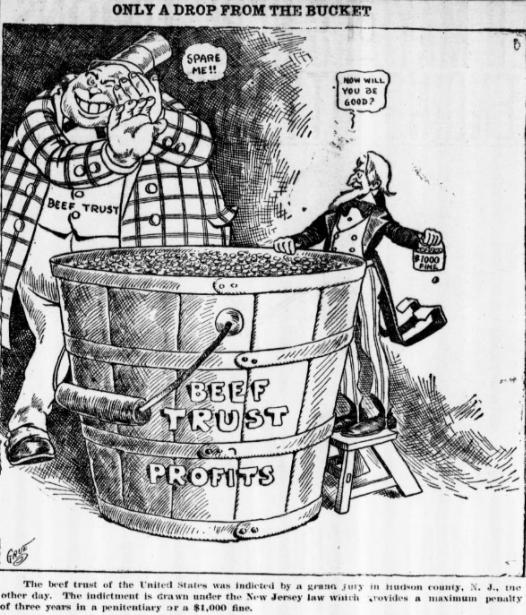

$340 Billion in Property Taxes Levied on U.S. Homes in 2022 - WORLD PROPERTY JOURNAL Global News Center

Excise Taxes Blue Concept Icon. Legislated Taxation On Products Idea Thin Line Illustration. Tax Levied On Commodities, Services And Activities. Purchase Fee. Vector Isolated Outline Drawing Royalty Free SVG, Cliparts, Vectors, And

Excise Taxes Blue Concept Icon Legislated Taxation On Purchased Goods Idea Thin Line Illustration Tax Levied

:max_bytes(150000):strip_icc()/Taxation_updated2-dfd2ae499d314d05972225d3f743f8aa.png)